10 insights from operational resilience leaders in financial services

The Fusion team recently hosted the second in our series of operational resilience roundtables, bringing together financial services organizations from all over the globe sharing insights, discoveries, and blueprints for success in operational resilience as we work toward a more prepared and prosperous future for all.

It was great to see many of the same faces from our London session returning with some new ones to talk about what has changed with financial services in an era of crisis. With almost 40 leaders from 27 of the world’s most well-known financial services organizations, it was a fascinating and engaging exchange. Our sincerest appreciation to all who attended, participated, and made the event a successful one.

It’s easy to take for granted the efforts of the teams that shielded us all from even greater impacts of the pandemic. These individuals prepare their organizations to weather the challenges that present themselves in crisis. Financial services has long been the tip of the sword against the world’s frailties. So, what is top of mind for these global leaders as they face the unprecedented set of challenges in pandemic’s wake and build the new normal?

These top 10 insights are a snapshot:

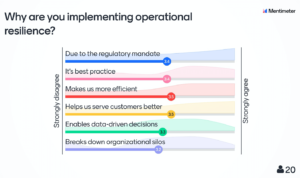

1. The ROI of Resilience Goes Beyond Compliance

Financial services is unique in both the myriad of regulatory obligations as well as the unique role the industry plays in ensuring global economic security and prosperity. But even with many of the formal obligations surrounding operational resilience deferred to allow firms to focus on the impacts of the crisis, many organizations are pressing forward with their plans for operational resilience. While the world has changed, it has only strengthened the case for a prepared and agile response.

2. Resilience is an Investment in Your Future

Resilience means knowing how to cope in spite of setbacks, barriers, or limited resources. There is no debate that financial service firms need to be resilient in order to continue as viable institutions. There is also no debate that resilience is a major investment, however, it is a worthwhile endeavor that yields dividends well into the future. In fact, it’s clear when talking to these leaders that in an era where virtually everyone has been touched by the lasting and negative impacts of crisis, strong resilience programs have become the new hallmark of successful financial services organizations.

3. The Art of Framing Critical Products and Services

As financial services organizations have become increasingly diversified, it becomes more difficult to ascertain priorities and focus. Where many organizations have gone through the process of identifying the key services they provide to customers, crisis – the great amplifier – exposed many areas in which the original assumptions needed to be reworked.

Furthermore, the vast changes sweeping the market drove swift changes in customer demand and the nature of service delivery, in turn, upending the way in which firms think about critical processes. In a May Deloitte survey of senior executives at financial services firms, 53% of respondents reported rethinking and digitizing client interactions as the highest strategic priority within their organizations post COVID-19.

The routine reassessment of criticality and the resultant reprioritization are healthy activities for organizations of any size to practice.

4. Geography Matters

4. Geography Matters

It may seem obvious, but the cultural characteristics of a region have a great bearing on the requisite approach. For large, multinational organizations, it’s not a one-size-fits-all model. Carefully weighing cultural variability and building plans that work with the grain of culture, process, and teams in place will make it more likely to stick.

5. Take and Outside-in, Inside-out Approach

Financial services organizations are actively building alignment on resilience strategies within the broader community as well as inside their organization. Sharing-based and crowd-driven initiatives are gaining more acceptance across industry ecosystems that include third parties, regulators, suppliers, and even competitors – leading to new operating models of resilience.

6. Effective Governance as a Gateway

6. Effective Governance as a Gateway

Clear and effective governance was cited as an important predecessor to building resilience culture – or, said another way, weaving a resilient mindset in the fabric of the entire organization. These battle-tested, core operating models established by the governing group become the crucial blueprint as firms begin to scale cross-functionally.

7. Making it Measurable

New computing and analytics technologies are allowing teams to further automate the collection of data and drive key insights which inform more comprehensive, real-time, integrated risk management. Further, as hard-to-quantify risks, such as reputation, continue to accelerate. Teams are looking to better measure the impact.

8. Importance of Building a Culture of Resilience

Everyone has a role to play in resilience. Alignment on common operating models is foundational. The approach varies greatly by geography. It’s not something that can be done overnight, but everything else has to follow.

9. Complexity of Setting Limits

When it comes to setting the limits by which you measure the impact of your business disruption (when it is time to raise the red flag), it’s key to demystify the process. Consistency is vital. Start with the customer perspective. What is the end impact of the disruption to the customer?

10. Teams are Taking Action

The pandemic changed many long-standing assumptions on a global scale. As a result, resilience teams are leading the way, revisiting their playbooks and leveraging situational insights to drive decision-making and next actions in a quickly evolving era.

Interested in operational resilience or financial resilience, something you read in this article, or learning more about our business continuity and risk management roundtables? Contact your account executive or account manager! If you’re new to Fusion, contact us.