Global regulators and industry leaders have been progressing their thoughts on operational resilience. This spring, Fusion participated in OpRisk’s Global Advisory Boards in three areas of focus for financial services firms: the evolving regulatory picture, competing in a future world of work, and n-party ecosystem risk.

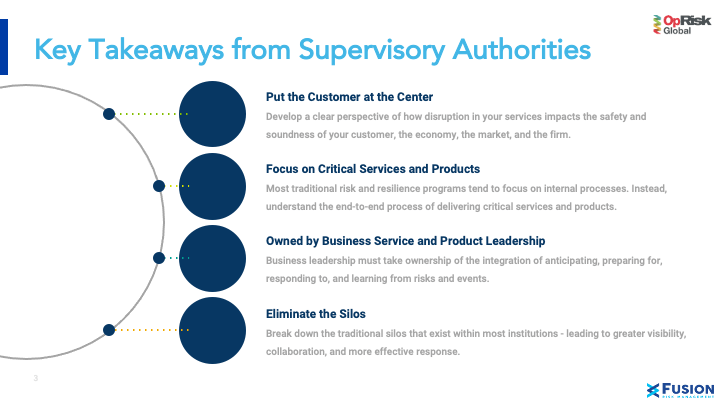

1. Regulatory Focus on Shared Outcomes

Supervisory authorities, and the industry advocacy groups working with them, are increasingly focused on the outcomes sought over-prescriptive approaches – namely ‘safety and soundness’ – to ease the burden of complying with multiple jurisdictional requirements.

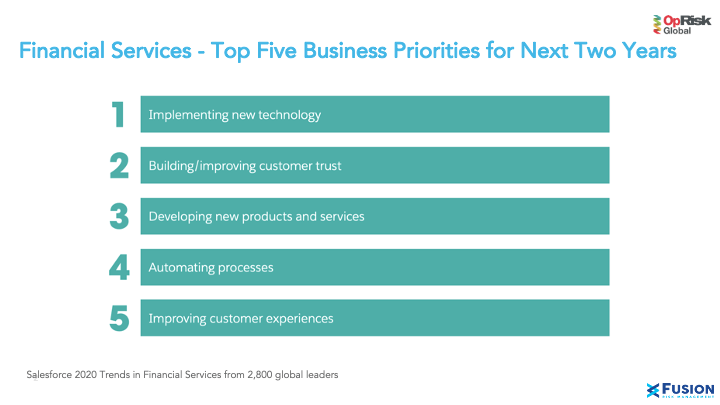

2. Embedding Risk and Compliance in Product and Service Line Functions

Strategic and disruption risks, like competitive challengers and changes in customer behavior, are presenting significant upsets to firms. As a result, financial services institutions are moving to embed risk assessment software and compliance functions in product and service teams, balancing the offensive-defensive motions of risk-taking and risk-avoidance − a growing consideration when planning new products, services, business models, etc. in financial services.

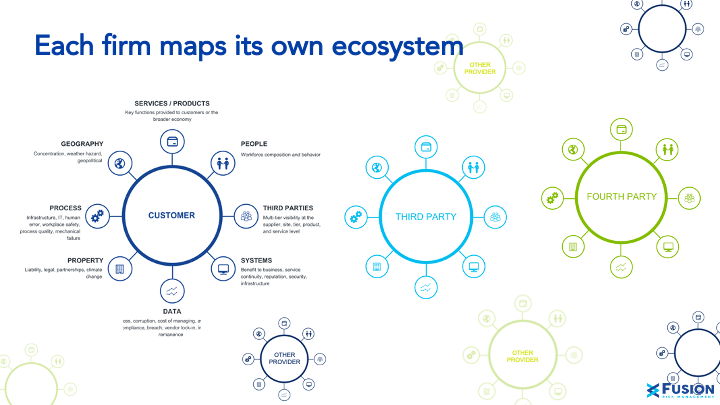

3. Growing Market Ecosystem Complexities

We are seeing a growing body of leaders refer to third-party/n-party risk as “ecosystem risk,” reflecting the complex dynamics, dependencies, and ripple effects that happen between entities in financial services (i.e., financial services, technical solution providers, and policy entities).

Looking Forward

It is clear that firms must take a centralized, data-driven approach to build a more operationally intelligent organization. As the regulatory landscape on operational resilience continues to evolve, forward-thinking firms are implementing improved operational and financial resilience throughout their organizations.